Are you accepted to a foreign university, yet unsure how your family will pay the first tuition invoice on time? For many Bangladeshi families, bank loans for students studying abroad turn that deadline into a workable plan, yet the loan choice gets confusing once you add sponsor paperwork, bank rules, and foreign transfer steps. City Bank, Bank Asia, Eastern Bank, Standard Chartered Bangladesh, and IFIC Bank each handle education funding and outward remittance in different ways, so the best choice is the one that matches your documents and your intake timeline.

This guide is for Bangladeshi students and guardians who want clear steps, clean comparisons, and fewer surprises. You will learn how to calculate your real loan need, compare domestic banks with international lenders, prepare a complete document pack, and avoid the common mistakes that slow approval and tuition transfers.

Quick answer: Choose the best-fit study abroad loan path

A study abroad loan decision in Bangladesh often comes down to three constraints: sponsor income documents, security options like property or fixed deposits, and how soon the university needs payment. And it helps to understand practical options for funding your studies abroad from Bangladesh. Domestic banks such as City Bank, Bank Asia, and Eastern Bank often work best when a parent or legal guardian can support the application with stable income and consistent bank statements. International lenders can work for students who do not have a collateral route, yet the fee structure and foreign-currency exposure can feel heavier in BDT terms.

Pick a domestic bank education loan when your guardian profile is strong, and you can complete branch verification without rushing the semester deadline. Pick an international lender when collateral is not available, and your university or program fits the lender’s eligibility rules. Many families use a mixed plan: scholarship or savings cover early costs and a loan covers the remaining gap, so the repayment burden stays manageable.

Step 0: Calculate the real study abroad budget before you apply

Step 0 means you calculate the loan gap before you fill out any form, so your loan request matches the university invoice and your outward remittance plan, especially if you’re planning your study abroad journey from Bangladesh. Banks and authorised dealer branches often ask for tuition and living cost documents, so a clear budget helps approval and transfers move faster. A Step 0 number also protects you from two common mistakes: borrowing too little and missing a deadline, or borrowing too much and carrying stress for years.

Start with your Year-1 cost of attendance:

- Tuition and mandatory university fees

- Accommodation and living costs (rent, food, transport)

- Medical insurance and required health costs

- Visa, biometrics, tests, and application fees

- Airfare and first-month setup costs

- A small safety margin for price changes and exchange-rate moves

Then subtract your non-loan funds:

- Scholarships and fee waivers

- Savings

- Family support

- Any confirmed assistantship or stipend

Loan needed = Year-1 costs − (scholarships + savings + family support)

Keep your Step 0 number realistic. A bank can approve a loan and still ask for more documents before the first tuition transfer is made, so your budget should match what you can prove with invoices and estimates.

Types of education loans for studying abroad (Bangladesh perspective)

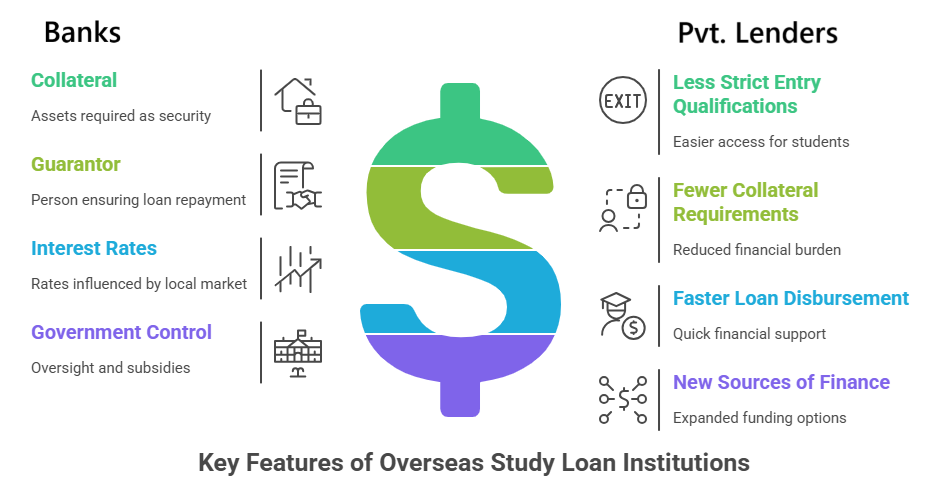

Bangladeshi students usually choose between two buckets:

- Domestic bank loans from Bangladeshi financial institutions

- International or private education lenders

Domestic banks often focus on the sponsor’s profile and documentation strength. International lenders often focus on eligibility rules tied to the university, program, and affordability checks. If your destination is the UK, it’s also useful to review UK student loan options for international students.

Domestic bank loans from Bangladeshi financial institutions

Domestic bank student loans usually rely on a parent or legal guardian as the main applicant or co-applicant. Banks review sponsor income, banking history, and the consistency of documents, then decide loan limits and repayment terms. Domestic loans feel familiar, yet they can involve more branch steps and more paperwork.

Examples of domestic bank options students compare

City Bank – Student Loan

City Bank publishes a student loan range of BDT 1 lac to BDT 20 lac and a tenor of 1 to 5 years. It also lists education-related expense coverage such as tuition fees, living expenses, medical insurance, and airfare.

Bank Asia – Student Support Loan

Bank Asia lists up to BDT 10,00,000 for study abroad, states no processing fee, and mentions repayment tenure up to 9 years, including a grace period on the product page.

Eastern Bank – EBL Edu Loan

Eastern Bank’s EBL Edu Loan page outlines eligibility and requirements for education financing, giving you a reference point for what a document-ready application looks like.

Why many families prefer domestic bank loans

Domestic banks can be easier to deal with when your family income is in BDT, and you want in-person support. A strong sponsor profile can help you access better repayment comfort and clearer account handling.

Where domestic bank loans create problems

Domestic loans can slow down when sponsor documents are incomplete, income records do not match bank statements, or property or fixed deposit documents are unclear. Even after sanctions, you still need outward remittance steps to pay the university, so timelines matter.

International private lenders and no-collateral options

International lenders exist because many students do not have property collateral or a strong sponsor profile for a domestic bank route. These lenders often use program and university eligibility rules, then apply affordability and repayment checks.

International lenders can help when domestic bank access is limited. You still need to read the total cost carefully since fees and foreign-currency exposure can change the real burden for a Bangladesh household.

Compare loan options: Domestic banks vs international lenders

A clean comparison goes beyond interest rate, and it also helps to understand living-cost vs tuition borrowing, so your budget matches what the lender will actually cover. Focus on approval logic, disbursement workflow, fees, and currency exposure.

| Factor |

Domestic Bangladesh bank |

International/private lender |

| Approval anchor |

Sponsor income, bank history, documents |

Eligibility rules, affordability checks |

| Security |

Often needs collateral or sponsor strength |

Often no collateral routes (case-based) |

| Transfer workflow |

Often includes Student File/outward remittance |

Often structured disbursement rules |

| Fees |

Processing/remittance charges can apply |

Origination/admin fees can apply |

| Currency exposure |

Costs can rise if tuition is in USD/GBP |

Repayment exposure often linked to foreign currency |

| Best fit |

Sponsor profile is strong, branch timeline works |

Collateral route is weak, program is eligible |

Use this comparison to decide the simplest path for your situation, and consider alternative ways to pay tuition fees when your preferred loan route or timeline doesn’t line up. A “low rate” is not helpful if remittance timing fails and you miss a tuition deadline.

Student File and outward remittance: the step most blogs skip

Loan approval is not the finish line. You still need a lawful transfer process to send tuition and approved living costs abroad.

Standard Chartered Bangladesh describes Student File as a way for Bangladeshi citizens to convert BDT for education expenses abroad and transfer education and living expenses.

IFIC Bank describes the Student File as an arrangement to remit foreign exchange for Bangladeshi students going abroad for education through authorised dealer branches.

What this means in practice

Your bank may ask for university invoices, a cost breakdown, sponsor source-of-funds details, and identity documents before remittance is processed, so it’s worth checking the Bangladesh UKVI bank list if you’re paying for a UK intake. Start this step soon after you receive the offer letter, so you can align loan disbursement timing with university deadlines.

Student loan eligibility criteria and documentation requirements

Most lenders look for three areas: admission credibility, sponsor strength, and document completeness. Eligibility rules vary by product and can change by bank policy, so treat published bank pages and branch offer sheets as the source of truth.

Personal and academic requirements

Banks and lenders usually want an admission offer from a recognised institution and clear academic records. Your passport, NID/birth certificate, and visa status can matter later for remittance steps.

Financial checks on a study abroad loan

Domestic banks check sponsor income, banking history, existing obligations, and the quality of supporting documents, and for UK-bound students, UK visa bank statement requirements can also shape what you collect. International lenders often focus on eligibility rules tied to the program and the school, then apply affordability checks.

Comprehensive loan documentation checklist (Bangladesh-ready)

Create one folder for fast processing.

Student documents

- Offer letter/admission documents

- Academic transcripts and certificates

- Passport and identity documents

- Visa documents, if available

- Photos, if required by the bank

Sponsor/guardian documents (common for domestic banks)

- Income proof (salary certificate or business documents)

- Bank statements (6-12 months are common)

- Existing loan or liability statements, if any

- Tax documents, if requested by the bank

Cost and transfer documents (often needed for remittance)

- Tuition invoice or official cost sheet

- Accommodation and living cost estimate

- Sponsor source-of-funds details

Keep copies of every receipt and confirmation. Universities often ask for proof of payment, and banks may ask for documents again during annual transfers.

Interest rates, fees, and repayment terms: what students must understand

A loan that looks cheap can become expensive when fees and timing are added. Your real cost is shaped by the rate, fees, repayment start date, and currency exposure.

Rate structure and total cost

Banks may offer fixed or variable structures depending on the product. Lenders may charge processing, admin, or remittance-related fees. Your goal is not the lowest headline number. Your goal is the lowest total repayable amount for a realistic repayment plan.

Grace period and repayment start date

Ask for the exact repayment start date in writing. Some plans start repayment after graduation. Some begin earlier. Ask how interest accrues during any study period.

Currency exposure risk

If your household income is in BDT and tuition or repayment is linked to USD/GBP costs, exchange-rate moves can raise the burden. Keep a realistic safety margin in your Step 0 budget and avoid borrowing beyond what you can support.

Step-by-step application process for study abroad loans from Bangladesh

A clean process saves weeks.

A 6-month practical timeline

Month 1: shortlist universities and lenders, build Step 0 budget

Month 2: collect sponsor and student documents, request invoices and cost sheets

Month 3: apply to at least two options, request written fee and repayment details

Month 4: respond fast to verification questions, start Student File planning

Month 5: review sanction letter, confirm transfer plan and deadlines

Month 6: sign agreements, complete disbursement and tuition transfer

What slows approval

Sponsor document gaps, mismatched income proof and statements, missing invoices, missing source-of-funds details, and late Student File preparation.

Alternatives and supplementary funding options

Loans work best when they are smaller and targeted.

Scholarships and grant opportunities

Apply early for scholarships and university aid, and review how to secure a scholarship from Bangladesh to reduce the loan amount you actually need. A small waiver can remove a large part of your borrowing need.

Part-time work options and budgeting

Check your destination’s visa rules for part-time work and build a realistic monthly budget. Keep expectations conservative. Tuition bills come first.

Smart borrowing rules that reduce debt

Pay early deposits from savings if possible. Borrow the gap, not the maximum. Pick housing and cities that reduce living costs without harming your study outcomes.

Common mistakes that lead to rejection or delays

- Loan amount does not match the cost sheet and invoices

- Sponsor income proof does not match the bank statement flow

- Student File planning starts too late, and the tuition deadline hits

- Fees and repayment start date are not confirmed in writing

- The family borrows the maximum limit without a repayment plan

Fix these early, and the process feels far smoother.

Frequently asked questions

Which Bangladeshi bank options are easiest to compare quickly?

Start with products that publish clear ranges and tenure, then confirm branch offer sheets. City Bank and Bank Asia publish student loan-related product details that help you shortlist.

What is Student File in Bangladesh?

Student File is described by banks as a structure to remit foreign exchange for study abroad costs through authorised channels.

How long can the process take?

Approval and transfers can take weeks, depending on document readiness and remittance steps. Build at least a few months of buffer around intake deadlines.

Can loans cover living costs and travel?

Many education loan structures allow tuition and approved living and travel-related costs, yet the final coverage depends on the sanction letter and remittance rules.

Conclusion

A solid study abroad plan in Bangladesh links three things: a realistic Step 0 budget, a lender that fits your sponsor profile, and a clear Student File/outward remittance path. City Bank, Bank Asia, Eastern Bank, Standard Chartered Bangladesh, and IFIC Bank each represent pieces of that system, and the best result comes from matching your documents to the simplest route.

If you follow the checklist, confirm fees and repayment dates in writing, and start remittance planning early, you can pay the university on time and keep future repayment stress under control. Use this guide to choose bank loans for students studying abroad with confidence and clear next steps.