Getting a visa to visit the United Kingdom involves following certain steps. One of these steps is showing proof that you have enough finances to support yourself during your stay. This proof is important because it helps the authorities make sure you won't face financial problems while you're in the UK. One way to show this proof is by providing a bank statement.

Let's see in detail what's an acceptable bank statement for UK visa application process.

What is an Acceptable Bank Statement?

An acceptable bank statement is a document your bank provides that outlines your financial transactions over a specified period, typically six months. It shows your financial stability and ability to support yourself during your visit to the United Kingdom.

Your bank statement is crucial in proving to UK authorities that you have enough money to cover your expenses while in the country. It gives insight into your income, savings, and spending habits, helping officials assess your financial capability to support yourself during your stay.

For example, suppose you're applying for a UK student visa. In that case, the authorities want to ensure you can pay for your living expenses, tuition, and accommodation. Your bank statement helps them assess whether you have the funds to support yourself throughout your studies.

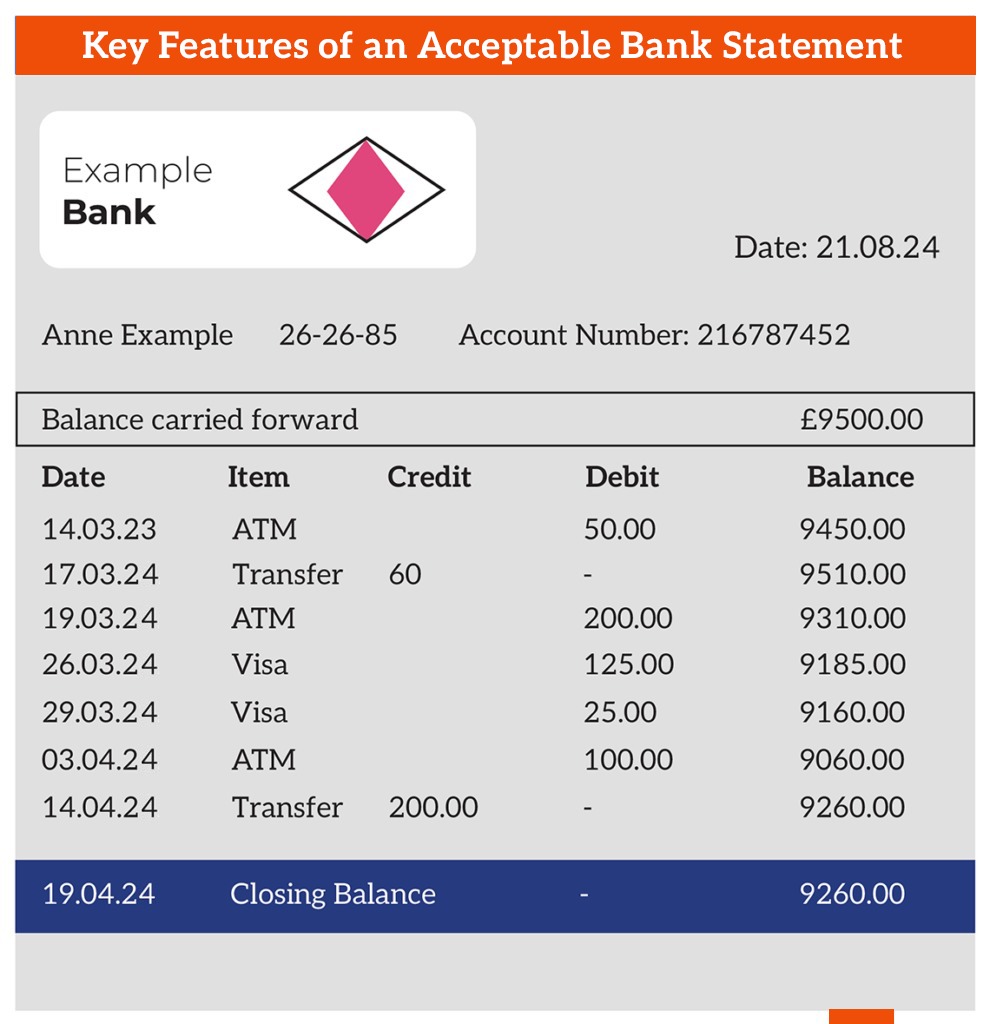

Key Requirements of an Acceptable Bank Statement

To ensure your bank statement meets the criteria for a UK visa application, it must have the following requirements:

Account Holder's Name and Address

The bank statement should clearly display your full name and current address. This ensures that the statement pertains to you and matches the information provided in your visa application.

Date of Issue

The statement must be recent and typically issued within one month of your visa application submission. An outdated statement may raise concerns about the current status of your finances.

Bank's Name and Logo

The statement should prominently feature the official name and logo of the issuing bank. This verifies the authenticity of the document. More importantly, the bank must be UKVI-approved.

Clear Transaction Details Over a Specified Period

Your bank statement should provide a comprehensive overview of your financial transactions over the past six months. It should include details of income, expenditures, and any significant transactions.

End Balance and Any Overdraft Facilities

The statement should conclude with your current account balance. Additionally, if you have overdraft facilities, they should be clearly stated. This helps assess your financial stability and whether you have sufficient funds to support yourself during your stay in the UK.

Currency and Conversion

Additionally, it should include clear conversion rates to GBP if your bank statement displays transactions in a currency other than GBP (British Pound).

Types of Accounts Considered

When submitting a bank statement for a UK visa application, various types of accounts are considered acceptable:

Savings Accounts

Savings accounts, where you save money for future use, are commonly accepted. They demonstrate your ability to accumulate funds over time.

Current or Checking Accounts

Current or checking accounts, typically used for everyday transactions like paying bills and making purchases, are also suitable. They show your regular financial activity and available balance.

Fixed Deposits or Term Deposits

Fixed deposits or term deposits, where you deposit a fixed sum for a specific period at a predetermined interest rate, can also be included. These accounts indicate your commitment to saving and potential interest earnings.

Common Pitfalls to Avoid

In the visa application process, pitfalls refer to common mistakes or errors that applicants may encounter. These can lead to complications or rejection of their visa applications. So, it's important to avoid certain pitfalls. Some common pitfalls to avoid are:

- Using Statements Older Than the Specified Period: Ensure that your bank statement covers transactions within the required timeframe, typically the last six months. Using an outdated statement can make your application incomplete or inaccurate.

- Submitting Statements with Irregular Transactions: Avoid including large or unexplained transactions that could raise suspicions. Maintaining transparency and consistency in your financial records is essential to demonstrate your financial stability convincingly.

- Relying on Accounts Not in Your Name: Make sure that the accounts in your bank statement belong to you and are in your name. Using accounts belonging to someone else, even if they are family members, can lead to doubts about your financial independence and credibility.

- Incomplete Documentation: Incomplete bank statements can lead to a direct rejection of your UK visa application. So make sure you provide all necessary and valid information.

Online Statements vs. Traditional Paper Statements

For your UK visa application, you may encounter two types of bank statements: traditional paper statements and online statements.

Traditional paper statements are physical documents your bank provides, typically mailed to your registered address. They offer a tangible account activity record and are often accepted as official proof of your financial status.

In contrast, online statements are electronic records of your account transactions, accessible through your bank's website or mobile app. If you're wondering, is an online bank statement acceptable for UK visa applications? The answer is yes. But, it must meet the requirements set by the UK visa office.

To validate the authenticity of your online bank statement, request a printed version from your bank and have it stamped with an official seal or signature. Some banks offer digitally authenticated statements for download on their online banking portals.

How Much Money Should Be in the Account?

While preparing your bank statement for a UK visa application, showing sufficient funds to cover your expenses during your stay is important. Although there's no fixed minimum requirement, the amounts vary for visa types.

For example, for a UK tourist visa, you need to have at least twice as much savings as you plan to spend in the UK. Additionally, a daily budget of roughly £100 to £150 per visitor should be met by your bank statement.

For an acceptable bank statement for UK student visa, it is required to prove funds equal to 1 year of Tuition Fees and 9 months of Living Expenses. It can vary depending on the education providers. Course fees are set out on the student's confirmation of acceptance for studies (CAS).

Maintain this balance consistently over the required duration, typically six months, to demonstrate responsible financial management. While fluctuations in your account balance are normal, aim for overall stability to avoid raising doubts about the reliability of your finances.

Alternatives to Bank Statements

If providing a bank statement is challenging, you can consider some alternatives. For example:

Sponsorship Undertakings

If someone else will be funding your trip, they can provide a sponsorship letter affirming their financial responsibility for your expenses during your stay in the UK. This letter should detail their relationship to you, their financial ability to support you, and their commitment to cover your expenses.

Financial Guarantee from a Third Party

Similar to sponsorship undertakings, a third party can provide a financial guarantee letter, assuring the UK authorities of their willingness and capability to cover your expenses during your visit.

Other Financial Documents Accepted by the UK Visa Office

In addition to bank statements, other financial documents may be accepted, depending on your circumstances and the type of visa you're applying for. These could be investment statements, property deeds, pay stubs, or income tax returns.

Frequently Asked Questions

What is Bank Statement for Visa?

A bank statement for a visa application is an official document that shows your financial history, including income, expenditures, and current balance, to prove your financial stability and ability to support yourself during your visit.

Can I use a joint account for UK visa?

Yes, joint accounts are acceptable, provided the applicant's name is included.

How much bank balance is required for UK visa?

Minimum balance requirements differ based on the visa category and individual circumstances. For a UK student visa, you need £1,334 per month if studying in London or £1,023 per month if outside London, up to a maximum of 9 months. For each dependent, you need an additional £845 per month in London or £680 outside London. This money must be in your account for at least 28 consecutive days, ending no more than 31 days before your application.

For more details, visit the official UK government guidance.

How many months bank statement is required for UK visa?

For a UK visa application, you typically need to provide bank statements covering the last 6 months to demonstrate financial stability and sufficient funds.

Does UK embassy verify bank statements?

Yes, the UK embassy verifies bank statements submitted with visa applications to ensure authenticity and sufficient funds, often through direct contact with the bank or other verification methods.

Do UK visa officers check bank statements?

Yes, UK visa officers routinely check bank statements to verify the applicant's financial stability, ensuring they have sufficient funds to support themselves during their stay in the UK.

Do I have to stamp my bank statement for UK visa?

Yes, for a UK visa application, stamped bank statements are required if they are not printed on official bank stationery. For online statements, have them stamped and signed by the bank or accompanied by an official bank letter.

Rejections Based on Bank Statements

Visa rejections often stem from inadequate financial documentation. Common reasons could be:

- Insufficient Funds: If your bank statement doesn't show enough finances to cover your expenses while staying in the UK.

- Irregular Transactions: Large or unexplained transactions may raise doubts about the legitimacy of your finances.

- Inconsistencies: Discrepancies between your bank statement and other financial documents can lead to rejection.

If your visa application is rejected, consider taking these steps:

- Review: Carefully review the reasons for rejection provided by the visa office.

- Rectify: Address any deficiencies in your financial documentation or provide additional evidence to support your application.

- Reapply: Once you've addressed the issues, consider reapplying for the visa with updated and improved documentation.

Conclusion

Submitting a comprehensive and accurate bank statement is crucial for a successful UK visa application. By ensuring your statement meets the necessary requirements and avoiding common pitfalls, you can easily get an acceptable bank statement for UK visa. Just make sure to submit proper documents and be prepared to handle any concerns raised during the application process.

See More: