If you hold EU pre-settled status and are planning to study in the UK, then student finance can seem confusing initially. Some students are informed that they are eligible and some are denied. Many learners receive conflicting information on whether funding covers tuition fees only or also the living expenses.

EU pre-settled student finance eligibility is determined by a number of associated factors, such as

- location of study in the UK,

- residence history,

- course start date, and

- whether you qualify for a tuition-fee-only support or fall into a full-support category.

In England, many students with pre-settled status are eligible to take out a Tuition Fee Loan, while living-cost support is more restricted and only available under certain conditions, like recognised worker or family routes.

Student finance rules differ between England, Scotland, Wales, and Northern Ireland and may change by intake year. This is why a single answer may not fit all.

Check this post to know how the assessment of eligibility happens in practice and what results can be achieved. You will also know how to check your own standing using official processes before you can submit an application.

Can EU pre-settled students get student finance in England?

In England, EU citizens with pre-settled status through the Student Finance England EU Settlement Scheme can receive UK student finance, the amount of which depends upon how they satisfy specific legal tests. Most eligible pre-settled students are only eligible for a tuition fee loan, while living cost support (maintenance loan) is only available if the student falls within a recognised full-support group, including an EEA or Swiss worker route, or one of a number of family or child routes.

The most crucial requirement is to determine which eligibility bucket you fit in prior to application. Student Finance England (SFE), which is managed by the Student Loans Company (SLC), evaluates eligibility based on immigration status, residence history and timing rules set by the Department for Education, so it helps to review a complete guide to UK student finance eligibility.

Do remember, the status for pre-settled status tuition fee loan England is not enough to get funding. How your situation fits the official eligibility examinations will determine your fate.

Typical eligibility outcomes in England

- Not eligible: You fail to qualify on residence or Withdrawal Agreement.

- Tuition-only support: You receive no Maintenance Loan, just a Tuition Fee Loan, which is paid over to your university (here’s how a tuition fee loan differs from a maintenance loan).

- Full support: You get support in terms of tuition fees and can also get a maintenance loan and other grants, but this is subject to category.

Notable: This section is applicable only to England (Student Finance England). Student finance regulations are different in Scotland, Wales and Northern Ireland.

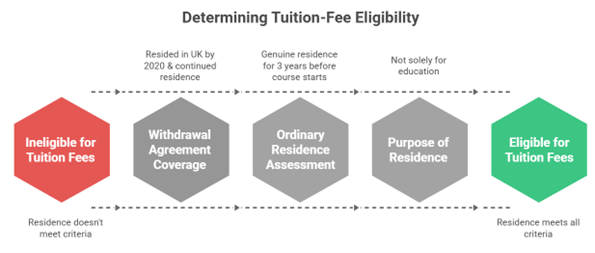

The eligibility rules that decide your outcome (status, dates, residence)

Three core tests will determine whether you will be unfunded, only tuition-fee funded or fully funded. These tests are not used individually, but they are used as a combination, and failing one test may change your outcome completely.

To begin with, there is the issue of course start and coverage of the Withdrawal Agreement student support. The UK-EU Withdrawal Agreements might apply to students who were living in the UK by the end of 2020 and have since continued to live in the UK. This security is at the centre of numerous tuition fee eligibility determinations.

Second, ordinary residence and a 3-year residence period are looked into. Student Finance England considers the ordinarily residential place in the three years preceding your course. This home must be in the UK, the EEA or Switzerland; however, this must be a real home rather than temporary or just for studying.

Third, SFE checks if your main purpose for residing in the UK was for education. If your primary reason for staying in the UK was only for study, then this can be a disqualifying factor even if you have pre-settled status. This evaluation is fact-based and in many cases, may entail powerful evidence.

Collectively, these tests determine the funding route available to you, and it can help to understand student loan basics for international students in the UK.

Eligibility tests checklist (Student Finance England)

|

Eligibility test

|

What SFE looks at

|

Why it is important?

|

|

Immigration status

|

Pre-settled status under the EU Settlement Scheme (proved through share code)

|

Affirms the lawful status and possible Withdrawal Agreement coverage.

|

|

Protection of Withdrawal Agreement protection

|

Were you residing in the UK on 31 December 2020 and continued residence?

|

Determines access to post-Brexit student finance routes

|

|

Ordinary residence

|

Where you lived, not where you studied or your nationality

|

Core test of eligibility of 'home' assessment

|

|

3 year residence rule student finance

|

Residence in the UK/EEA/Switzerland in the 3 years preceding the course start.

|

Required of the tuition fee funding routes

|

|

Not primarily for education

|

Evidence that your UK residence was not solely to study

|

Common refusal point to pre-settled students

|

|

Course and provider eligibility

|

Approved course, eligible university, proper intensity

|

Student finance is only applied to recognised courses

|

|

UK nation correctly applied

|

Correct application made to Student Finance England (if you are studying in England, then you need to apply to SFE, even if you are living in Scotland, Wales or Ireland)

|

The incorrect application to the wrong nation in UK results in automatic refusal

|

These tests are applied by Student Finance England, rather than the Home Office. Fee status is determined by universities, whereas SFE/SLC determines loan eligibility, and the results may vary.

What funding can you get with pre-settled status?

In the case of EU pre-settled status students in England, which routes of student finance are open to you depends on which route of eligibility you fall within, rather than just being pre-settled. The guidance provided by GOV.UK draws a strict line on the difference between tuition-fee-only eligibility and full support, which involves assistance on living costs.

Numerous pre-settled students are eligible to receive the requirements of tuition fee funding, with full assistance being restricted to several classes, including recognised EEA or Swiss worker paths and some family or child-based paths.

Types of funding route (undergraduate study in England)

|

Financing model

|

Pre-settled status (tuition-fee-only model)

|

Pre-settled + worker/family (full-support)

|

Settled status (baseline)

|

|

Tuition Fee Loan

|

Available in case of residence rules fulfilled

|

Available

|

Available

|

|

Maintenance Loan (living costs)

|

Not usually available

|

May be available if conditions are met

|

Available (subject to household income)

|

|

Disabled Students’ Allowance (DSA)

|

Generally available if eligible

|

Available

|

Available

|

|

Dependents’ grants

|

Not available

|

May be available if conditions are met

|

Available

|

|

Childcare grants

|

Not available

|

May be available if conditions are met

|

Available

|

Evidence usually required:

- EUSS status proof (student finance evidence share code)

- Three-year residence (address history, tenancy, bills, bank records) evidence. (Check UK bank options for international students)

- Where applicable, route evidence of worker (employment contract, payslips, P60, evidence of actual work)

Tuition Fee Loan routes for pre-settled students

Most pre-settled EU students are only eligible to take a tuition fee loan provided they are three-year UK/EEA/Switzerland residents and fall under the Withdrawal Agreement. Under this route, the loan is refunded straight to the university, and the students still have to cover the cost of living, except when they belong to some other category of support, so it’s worth planning ways to cover tuition without student finance.

Full support routes that can apply even with pre-settled status

Other students for family member eligibility student finance EUSS can obtain full student finance, including a maintenance loan, if they meet additional criteria. Typical examples are EEA or Swiss workers, some family members of workers or children of current or former workers where supporting conditions have been established. These are routes that are heavy in evidence and assessed on a case-by-case basis.

Part time and intensity threshold

For part-time courses in England, EU pre-settled student finance eligibility often depends on whether your course meets a minimum intensity threshold. SFE requires the part-time course to be atleast 25% of the equivalent full-time course to be eligible for part-time tuition fee loan EU students.

Home fee status vs student finance: The difference between the two but not their equality.

The status of home fees and the eligibility of student finance are two concepts that are close but not identical choices. Universities determine whether to charge you home or foreign tuition fees, and Student Finance England via the Student Loans Company, determines whether you can get loans or grants. Both tests take into account the nationality, immigration status and ordinary residence student finance, but they are guided by different rules.

Due to this two-track system, it is possible to be considered a home-fee student by a university but still receive only a tuition-fee funding from Student Finance England. In some cases, you get a different result from each assessor.

Students who are in the pre-settled status of the EU are usually required to complete the two processes separately.

Who decides what?

|

Decision area

|

Who makes decisions

|

What they evaluate

|

|

Immigration status

|

Home Office

|

EUSS pre-settled or settled status.

|

|

Fee status (home or overseas)

|

University

|

Immigration status, ordinary residence, and fee regulations.

|

|

Eligibility of student finance

|

Student Finance England / SLC

|

Loan and grant eligibility, under DfE rules.

|

In case the decision made by your university regarding the status of your fees does not go hand in hand with your student finance outcome, you may request a formal review of the same by the concerned body.

Universities have an internal system of appeal of fee status, while Student Finance England permits a reassessment on presentation of new or more precise evidence.

How to apply (and avoid delays): evidence, share codes and common refusals

Applying for student finance with pre-settled status is not predominantly about the form, but it is about providing clear and well-organised evidence. A majority of the delays and refusals occur because residence history is unclear or the right immigration evidence is not connected early in the process. If you are also budgeting around funding, review bank loan options for studying abroad. You should get ready to apply with a ready evidence pack to save you a lot of back and forth with Student Finance England (SFE).

The ideal application process

|

1. First check your likely eligibility.

|

Please use the official GOV.UK undergraduate student finance checker nationality residency and calculator to ensure that you are on a tuition-fee-only route or a full-support category.

|

|

2. Make your immigration and residence documents ready.

|

Create your share code EUSS to demonstrate pre-settled status and trace your three-year time scale of residence up to the start of your course.

|

|

3. Make an application via the appropriate channel.

|

The majority of students use online applications with Student Finance England, although in certain instances of cases only concerning the tuition fee, some may be requested to provide further evidence on their own. Do as you are instructed on your account.

|

|

4. Respond quickly to evidence request.

|

In case SFE requests clarification, attachments should be uploaded as soon as possible and copies stored with the dates of submissions so that there is an easy audit trail.

|

Evidence checklist (typical)

- EUSS pre-settled status share code.

- Discuss history in the past three years.

- Tenancy agreements, council tax bills or utility bills.

- Bank statements involving the UK or EEA activity.

- School, college or employment records.

- Evidence of worker route where appropriate (employment contract, payslips, P60).

Common reasons why students are informed that they are ‘not eligible’ and how to rectify it

• Covered the wrong UK nation.

Make sure that you apply to Student Finance England, not Scotland, Wales, or Northern Ireland.

• Residence is judged as ‘majorly for education’.

Present stronger evidence of actual residence beyond study.

• Lacking or poor evidence of worker routes.

Provide evidential documents of work or economic activity where necessary.

In more complicated cases, such as family-member routes or disputed residence decisions, it is highly advisable to consult an international student advisor within a university or UKCISA fee status EU Settlement Scheme.

Frequently Asked Questions

Do EU pre-settled students get a Maintenance Loan in England?

Not usually. Most pre-settled students in England qualify for a loan for EUSS pre-settled tuition fee only. Maintenance Loan can only be granted when you fall under one of the full-support categories (e.g., EEA worker student finance full support or Swiss worker route) and submit supporting evidence.

Is pre-settled status enough for “home fees” at a UK university?

Not by itself. Immigration status and ordinary residence rules are used by universities separately to determine home fee status pre-settled status. The home fees are offered to many students with pre-settled status, and it does not necessarily imply that they are entitled to full student finance.

What counts as the 3-year residence period for pre-settled status maintenance loan eligibility?

Three years prior to your course start date are checked up on. The residence should be in the UK, EEA or Switzerland but must be ordinary, not temporary or merely for study.

What if I arrived in the UK after 31 December 2020?

This is because any arrival after this date will be confined to the Withdrawal Agreement. It may still be subject to some tuition-fee routes or even full-support routes, but you have to make sure of your situation using the official advice.

Can I qualify through my parent/partner (family member categories)?

Possibly. Some of the family member or child paths connected with an EEA or Swiss worker can open the door to full support, though they are evidence-intensive and case-specific.

What evidence do I need to prove pre-settled status and residence?

You are typically required to provide an EUSS share code, as well as the documents of your residence history. They might demand further evidence, and this will depend on your route to eligibility by Student Finance England.

How do rules differ in Scotland, Wales, and Northern Ireland?

The UK countries have their own system of student finance alongside varying eligibility criteria. Always request it from the funding body of the country you are going to study in.

Conclusion

EU pre-settled student finance eligibility is available, but the results will depend on jurisdiction, residence history, and the eligibility route. Numerous students are only eligible to fund their tuition fees, whereas full support is restricted to certain applications like recognised worker routes. Home fee status and student finance are similar, but they are evaluated independently.

Next Step: You can complete the official eligibility checker and create a transparent three-year residence history. Also, ensure that you prepare your EUSS and supporting evidence well in advance.

It is vital that you respond promptly to requests made by Student Finance England. Making these steps early will present you with the best opportunity of not being behind schedule and getting the funding you deserve.